dislocated worker fafsa benefits

Yes means the students parent is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an automatic zero Expected. Your parentparents are considered dislocated workers if they.

How To Answer Fafsa Question 89 Parents Untaxed Income

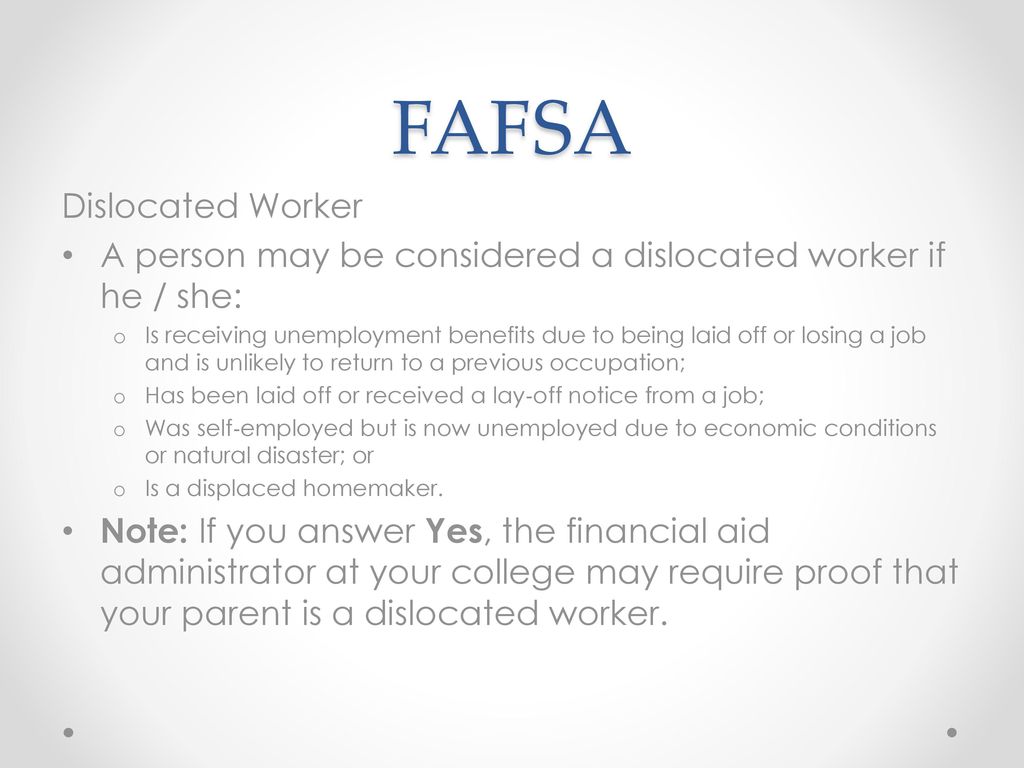

The FAFSA application includes a question about youyour parents dislocated worker status as a way to calculate your Expected.

. FAFSA says that anyone who is receiving unemployment benefits because they were laid off fits under the umbrella of a dislocated worker. You are considered a dislocated worker if you. This does not apply to.

Yes being a dislocated worker affects FAFSA. Name of Dislocated Worker_____. Citizens or certain classes of noncitizens are eligible for Title IV aid.

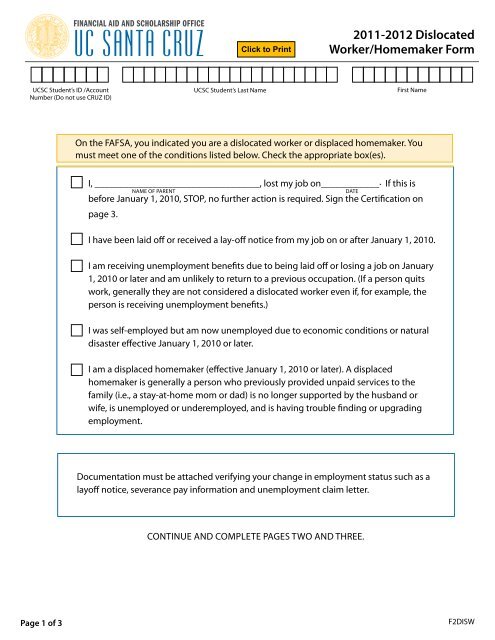

Are receiving unemployment benefits due to being laid off or losing a job and are. There are several situations when the person is qualified as a dislocated worker at FAFSA. Firstly it refers to those who are currently receiving unemployment benefits.

A dislocated worker status can have a significant impact on your Expected Family Contribution EFC. Federal Student Aid. Federal Student Aid.

What is a dislocated worker. I am receiving unemployment benefits due to being laid. However other students can still submit the FAFSA because they might be eligible for aid from.

According to the Department of Education a student or parent can qualify as a dislocated worker if they. This is a parent who has lost their job out of their control. The Adult and Dislocated Worker Program under Title I of the Workforce Investment Act of 1998 is designed to provide quality employment and training services to assist eligible individuals in.

Dislocated Worker Verification Worksheet 2022-2023 Federal Student Aid Programs You indicated on the 2022-2023 Free Application for Student Aid FAFSA that you your spouse or. Have been laid off Are receiving unemployment benefits as a result of being laid off Are a displaced homemaker stay-at-home student who. In general a person may be considered a dislocated worker if he or she is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to.

According to FAFSA a dislocated worker can also be the spouse of an active duty Armed Forces member who has lost a job because of required relocation. On your FAFSA you answered Yes to the question As of today is either of your Parents or. I was furloughed in March 2020 of my job due to.

What FAFSA says its pretty confusing about dislocated workers. The EFC is a measure of your familys ability to pay for your education. Is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a previous occupation I.

Have been laid off.

Does Being A Dislocated Worker Affect Fafsa Zippia

Dislocated Worker Program Minnesota Department Of Employment And Economic Development

How To Answer Fafsa Question 92 96 Student Federal Benefit Status

Dislocated Workers Definition Examples And Faq Zippia

Calameo Job Loss And The Fafsa

Federal Student Aid On Twitter We Have Money To Help You Pay For College Fill Out The Fafsa To Apply Https T Co Oabs2l19f6 Twitter

Using The Retrieval Tool Smu Enrollment Services

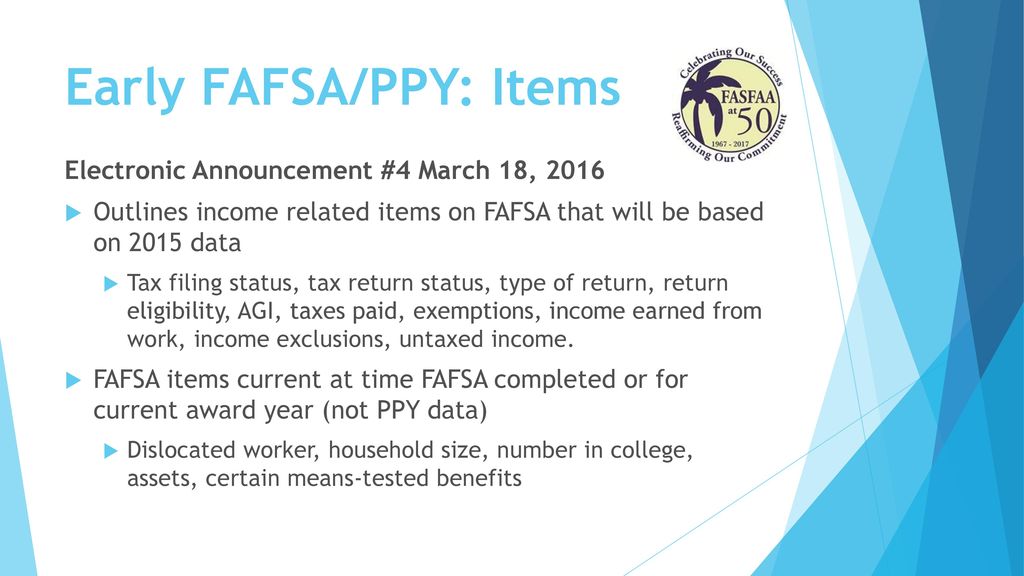

Senior College And Financial Aid Night Ppt Download

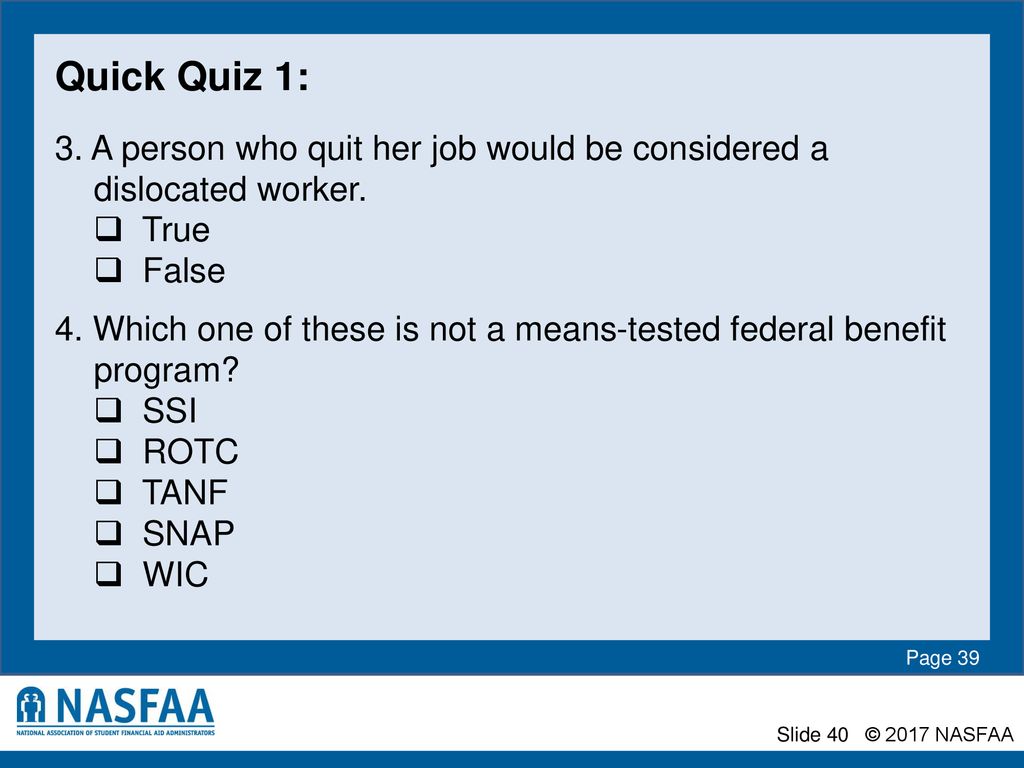

The Application Process A Nasfaa Authorized Event Presented By Name Of Presenter Association Location Date Ppt Download

How To Answer Fafsa Question 97 Dislocated Worker Status

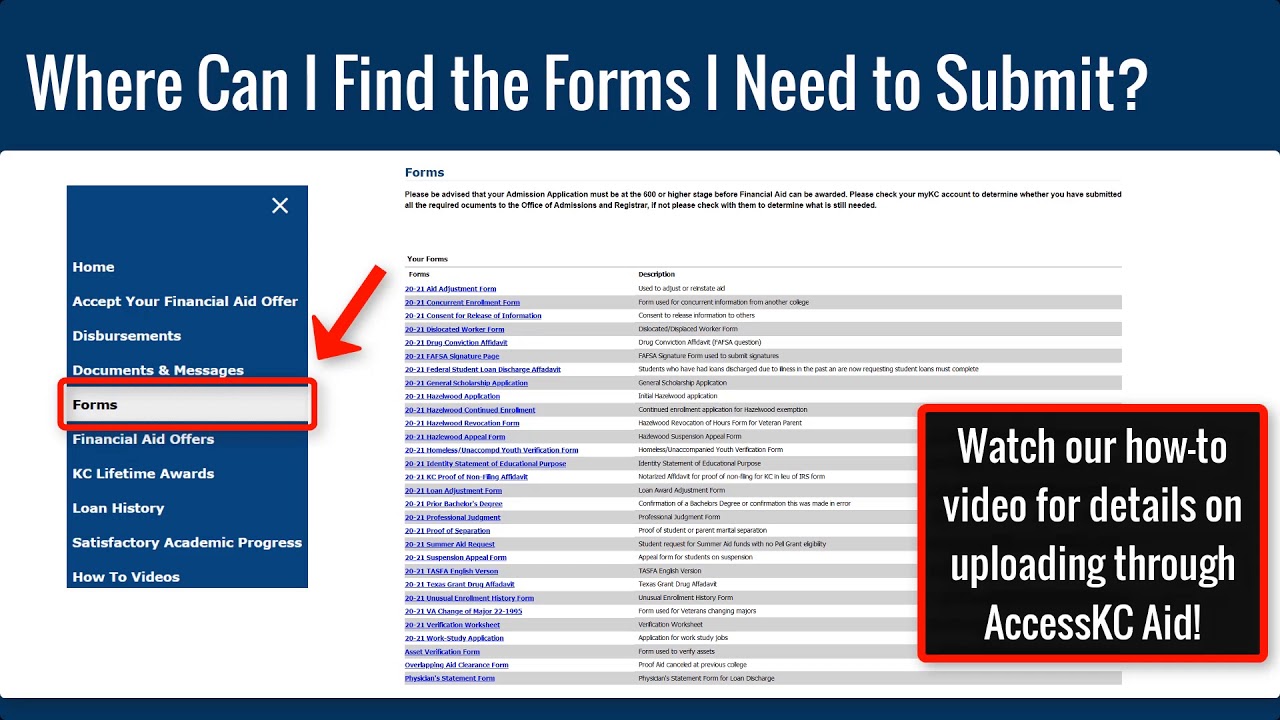

Financial Aid Forms Kilgore College

What Is A Dislocated Worker On The Fafsa Scholarships360

Verification Comment Code Ppt Download

What Is A Dislocated Worker On The Fafsa Frank Financial Aid